Prevent Insurance Fraud: Mobile Telematics Helps Improve Claims Management

How mobile telematics helps insurance companies to improve claims management

The current generation of smartphones can increase and broaden our abilities to improve our lives. With great potential in product development, mobiles can help simplify the process of catering to the customers’ needs. For a reliable example, we can look at how digitalization is being introduced in the field of insurance, resulting in more and more ways of connecting with customers. Transition to the new digital and mobile services increases the rate at which products appear on the market and become available for everyone. On the other hand, there is a major setback for digital services development that insurance companies are compelled to face — insurance fraud.

Why it is important

MOBILE TELEMATICS TO PREVENT $40 BILLION LOSS ON INSURANCE CLAIMS FRAUD

Automobile insurance claims fraud is one of the biggest and most frequent kinds of fraud, that can cost companies billions of dollars. Auto insurance fraud diverges from misrepresented facts on insurance applications, enlarged insurance claims, faked accidents, claims submitted for exaggerated damages and injuries that never occurred, and even to falsifications of auto theft. The FBI study showed that the total cost of insurance fraud in the U.S. is estimated to be more than $40 billion per year, meaning that on average, a customer will have to spend between $400 and $700 per year in the form of increased premiums.

That is where mobile telematics can step in and take on a huge role of fraud deterrent. Devices that are constantly monitoring customers’ data make it almost impossible to cover up instances of violation, made to inflate (or create) an insurance claim. And vice versa, just as simple it can help to treat compliant clients accordingly. Making a car location, its behavior, and motions fully transparent, drivers are less likely to fake, make up, or exaggerate the accident.

In this post, we have collected the main information on how mobile telematics enhances the claims process and prevents claims fraud the fraud management process by creating a more transparent B2C connection to reduce the number of insurance claims fraud cases. It is fair to say that the telematics system is an efficient instrument for detecting fraud. In this article, we point out why mobile telematics may be more effective than conventional approaches, and to what extent it may contribute towards businesses’ revenue growth as well as lowering costs and losses on premiums.

Automobile insurance claims fraud is one of the biggest and most frequent kinds of fraud, that can cost companies billions of dollars. Auto insurance fraud diverges from misrepresented facts on insurance applications, enlarged insurance claims, faked accidents, claims submitted for exaggerated damages and injuries that never occurred, and even to falsifications of auto theft. The FBI study showed that the total cost of insurance fraud in the U.S. is estimated to be more than $40 billion per year, meaning that on average, a customer will have to spend between $400 and $700 per year in the form of increased premiums.

That is where mobile telematics can step in and take on a huge role of fraud deterrent. Devices that are constantly monitoring customers’ data make it almost impossible to cover up instances of violation, made to inflate (or create) an insurance claim. And vice versa, just as simple it can help to treat compliant clients accordingly. Making a car location, its behavior, and motions fully transparent, drivers are less likely to fake, make up, or exaggerate the accident.

In this post, we have collected the main information on how mobile telematics enhances the claims process and prevents claims fraud the fraud management process by creating a more transparent B2C connection to reduce the number of insurance claims fraud cases. It is fair to say that the telematics system is an efficient instrument for detecting fraud. In this article, we point out why mobile telematics may be more effective than conventional approaches, and to what extent it may contribute towards businesses’ revenue growth as well as lowering costs and losses on premiums.

Identifying hard and soft fraud

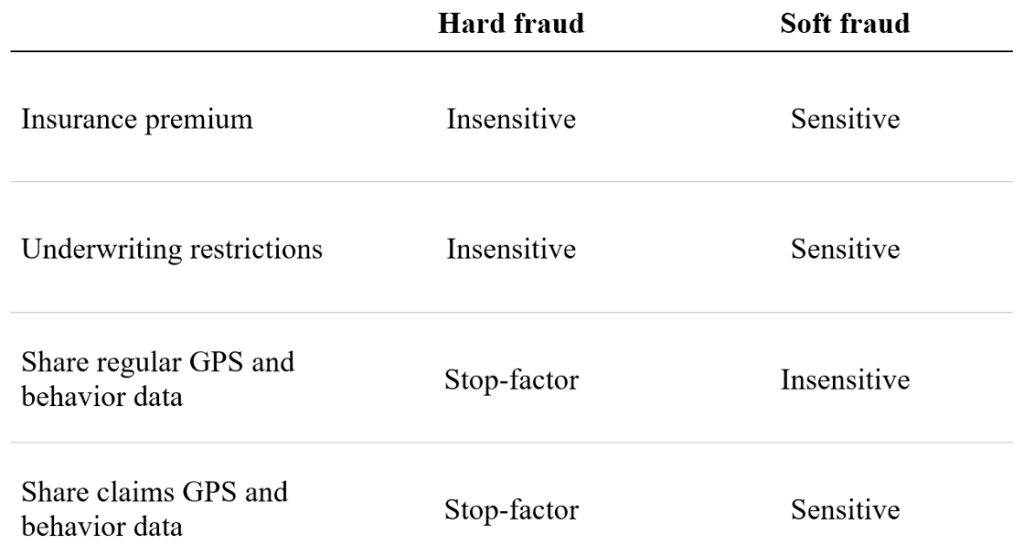

Types of insurance frauds may vary in different systems, but the judicial one categorizes car insurance fraud as Hard and Soft.

Hard fraud:

Intentionally faked accidents, thefts, losses, collisions, damages, or injuries in order to claim payment from an insurance company

Soft fraud (also known as opportunistic fraud)

Falsification or exaggeration of some part of the damage, caused in a valid insurance case, to obtain more benefits from an insurance company.

Hard fraud is well-planned and can be performed by crime rings to cause the theft of billions of dollars. As The Balance stated in the article about extreme cases of insurance fraud, various fraud crimes can cost $80 billion dollars annually. Soft fraud, in other words, household fraud or opportunistic fraud, is usually a whim of a customer to attempt to receive a higher payment. Two types of fraud are different in nature and are supposed to be handled differently.

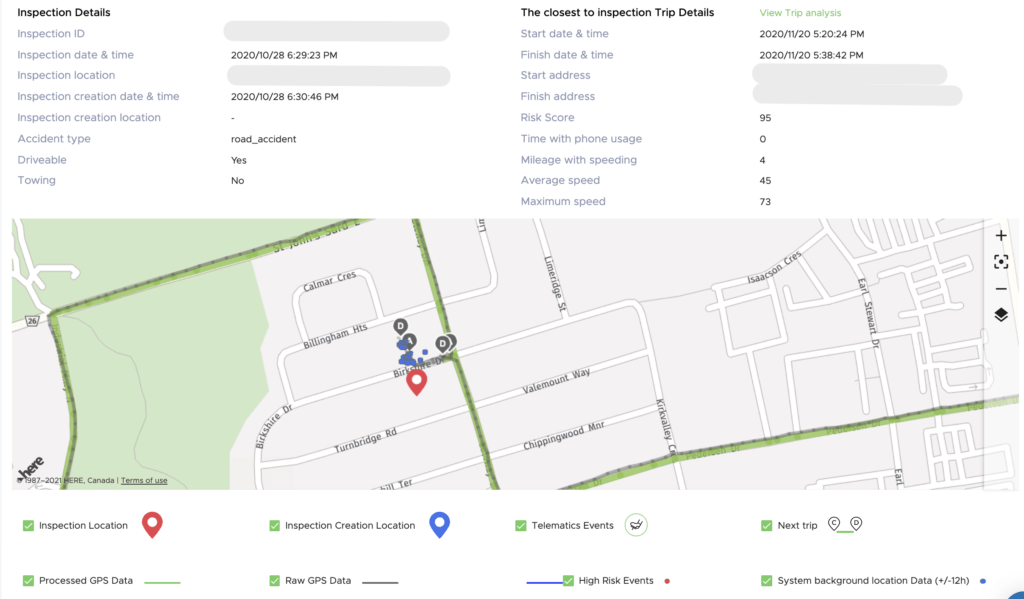

Mobile telematics provides a set of innovations to prevent car insurance claims fraud. If hard fraud is a deliberate plan that exists before a policy is purchased, an entry barrier should be set, to prevent criminals from applying for insurance. And if soft fraud is an attempt (that usually occurs in the first 24 hours after a road accident) to gain a higher payout from the company, a faster recognition of an accident should be available. In this case, an insurance company gets a claim that is filled almost immediately after the event. Having access to additional data that is provided by the telematics system in relation to the event, reduces the chance of soft fraud.

Claims fraud sensitivity table

Mobile telematics prevents car insurance claims fraud

How mobile telematics leads to loss reduction

Therefore, we have three main factors that have a great impact on reducing the loss ratio:

1. Fraud prevention — by making data and GPS sharing obligatory, we restrain criminals from becoming our clients and attempting fraud.

2. High-risk driver detection — based on our scoring model, insurance companies are able to detect careful drivers from daredevils and raise prices for the latter.

3. Behavior modification — with rewards and the aspect of competing for the best score, it is possible to influence driving behavior to make it safer and reduce high risks of insurance claims.

An easy solution for your business

Damoov provides the full suite of embedded mobile telematics services, including Telematics SDK, Mobility platform to process and analyze driving data, API services to consume services, analytics and data, Datahub – self-service portal to o manage product and work with data via web-portal, and even Zenroad — the open-source telematics mobile application — a full-function telematics app that companies can use straight away to solve the issues we covered in the article.

It takes less than 12 hours to add mobile telematics capabilities to any mobile application, using Telematics SDK and API services for the development of native and cross-platform apps like Flutter, ReactNative, and others. Simple integrating features are at your service to bring the telematics system to your customers through their browsers, mobiles, smartphones as soon as possible.

Customers from more than 18 countries trust our technology and have already built products using our telematics suite. We at Damoov are making it possible for companies to focus on other product development, by implementing our telematics infrastructure that can reduce R&D costs by 70% today. By changing the way customers approach usage-based insurance products, forming enough data for which usually can take up to a whole year, we can make it easier for you to develop smart driving apps, save money and time. We provide contactless mobile telematics that utilizes smartphone capabilities even in the background mode, to make sure that nothing distracts the customer from driving, and the insurance company gets all of the required data.

Frequently Askes Questions(FAQ)

How is telematics used in insurance?

With Telematics motor insurance or UBI, insurance companies will understand the car owner’s risk profile based on the distance covered, the average speed of the vehicle, frequency of using the vehicle, and the overall driving skills. This information is used to charge an appropriate premium.

Can telematics increase premium?

Yes. If the telematics device records that you’re regularly speeding or driving dangerously, your insurer has the right to increase your premium.

Do insurance companies check black boxes?

A black box can detect a driver’s speed, location, acceleration, braking, cornering, daily mileage, and other driving habits. Car insurance companies use the information black boxes detect to determine premiums and discounts for drivers participating in telematics insurance programs, also called usage-based insurance.

Useful links

- Company website: https://damoov.com

- Open-source telematics app: https://damoov.com/telematics-app

- Telematics SDK: https://damoov.com/telematics-sdk

- Telematics API: https://damoov.co/api-services

- Developer portal: https://docs.damoov.com

- Datahub: https://app.damoov.com

- Github: https://github.com/Mobile-Telematics