Insurance telematics: How to Start an InsurTech Company

Mobile telematics provides insurers with a colossal amount of knowledge and data that makes it possible to develop underwriting and predict the costs of maintaining insurance coverage. Telematics is a sure way to stay away from risky drivers and attract low-risk ones by ensuring competitive prices. As a result, it allows insurers to influence the whole insurance market by granting affordable insurance and building profitable telematics startups.

In this post, we covered one of the success stories that can become a guide to opening your insurtech telematics start-up. You can learn how your new business can disrupt the market by presenting new types of customer experience and digitizing insurance products, with the help of mobile telematics provided by Damoov

TELEMATICS HISTORY: MGA TO BRING INSURANCE TELEMATICS BACK TO BUSINESS

Telematics, despite being a relatively new feature, has a long story in the insurance business.

One of the oldest insurance companies and one of the largest car insurance providers, Progressive started using telematics data in underwriting in early 2011 with the product called “Snapshot”. Pioneering in using different metrics, the company was managing to collect driving data quite easily, but not using the information to its full capacity yet. Many insurance companies followed along and started using telematics. It was clear that the new technology is somewhat of a breakthrough and would soon completely change the insurance business.

Although in some time the market started facing a problem: the classic insurance companies were unable or unwilling to change their ways in order to implement telematics in their underwriting development. The word about telematics was going around, but in the end, not much was being done. Big companies appeared to be too conservative and unwieldy in some ways.

As a result, insurers lost interest in telematics — companies were disappointed, some telematics players went bankrupt, and the insurance market was no longer interested in this technology. But there was still hope. And entrepreneurs started looking for new ways to rev up telematics — to leverage telematics without having to deal with big classic insurance companies’ resistance.

In 2017 a new company appeared on the market — Root Insurance. What did they do? They followed an agent scheme. By receiving an MGA license, they were able to sell policies, reinsure the risks, and did not have to go above and beyond to convince an insurer that telematics is needed.

People from Root believed in telematics and its abilities. They understood a simple relation: if on average, a car owner drives three times more than a regular driver, they are creating more risks. This means that the more you drive your car, the more there is a chance of an accident. And it does not even matter whether you are a good or a bad driver, it is a statistical fact. They noticed that a driver with mobile telematics drives safer, eventually resulting in fewer losses. In the long run, it meant that financially Root was doing much better than other insurers.

They took off. Root Insurance became a beacon of hope for the future of car insurance. It became clear, that the future of telematics is directly tied to the continued advancement of operational intelligence. Many companies started using the same model Root used because it turned out that you do not have to go above and beyond to convince big insurance companies that telematics works — you can just take it and start leveraging it yourself. And financial status was not a problem, because they could reinsure almost all the risks in big insurance companies. And the same strategy works up to this day.

WHAT IS MGA?

MGA — a managing general agent is defined legally as “an individual or business entity appointed by an insurer to solicit applications from agents for insurance contracts or to negotiate insurance contracts on behalf of an insurer and if authorized to do so by an insurer, to effectuate and countersign insurance contract.

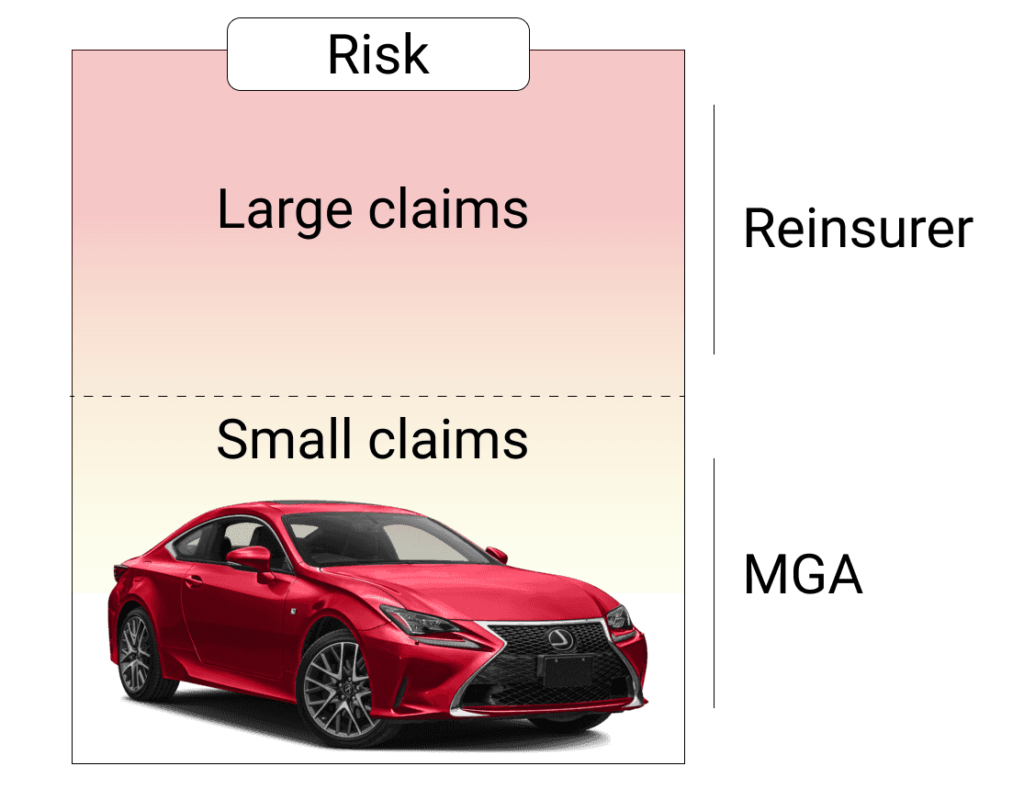

Insurance is a business full of risks, both literally and figuratively. When insurers have to work with potential big losses, they divide them into smaller chunks and insure the risks in other companies. Such action is also known as Layering. It is a method of allocating automatic reinsurance among several reinsurers. Using this method, reinsurance is ceded in layers that are defined in terms of amounts of insurance. One reinsurer will receive all reinsurance up to the limit of the first layer and so forth depending on the number of layers.

This way, even if the accident occurs, and the company has to pay out the losses, it will not take as big of a hit as it could have. MGA itself, instead of a big insurer, can take on the job of controlling risks and as a result, get reasonable profit.

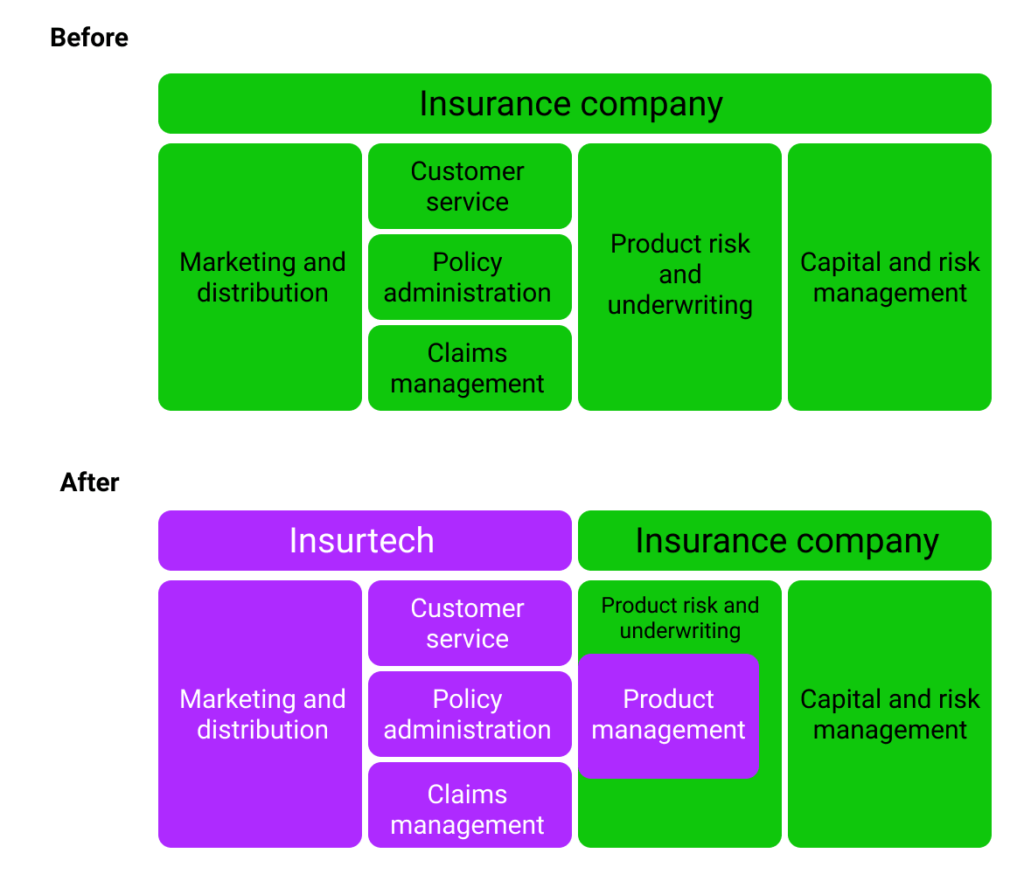

MGAs TO CHANGE THE WAY INSURANCE BUSINESS WORKS

Down below we can see how the insurance business transformed, and in which ways MGA differs from an insurance company.

In the purple part of the table, we can see what the MGA model looks like.

MGA is the new type of company. MGAs take on marketing and distribution, so usually, they have to be client-oriented: friendly, outgoing, and ready to help at any given time. MGAs also take the policy administration because clients buy directly from their mobile apps or websites. They take on claims, but they do not have to worry about vendor management because they use the insurers’ dealer base in exchange for a client base that is going to be distributed across those dealerships.

Everything that involves interacting with clients and creating products is MGAs’ field of interest. And the classic scheme of managing risks, which involves deeper underwriting with big risks such as theft and total loss of the vehicles, would remain under insurers’ control. Even though the fundamental risks remain on the insurers’ (or reinsurers’) level, almost everything that is left to the MGA can be affected by mobile telematics. To put things clearly, MGAs have the tools that help to significantly lower the levels of the loss ratio and better the financial parameters in comparison to the classic insurers.

For example, you have 100 clients a year. Your annual premium after selling insurance is $100 000. You understand that you pay out $70 000 as claims — 20 losses, $3500 each. That is why you have to reinsure — this time you were lucky that it was only 20 for $3500 — but what if the car theft or total loss happens? That can cost more than $50000 for each case.

It is easy to see that such disproportion can easily destroy a company if it is not ready. To prevent that, MGAs spend money on reinsurance. With $100 000 earned by selling insurances, a fee of $10 000 every month paid to the reinsurer (just to be ready in case of a loss of more than $100 000) will be a sure way to feel secure and cut some unneeded risks, because now it is the responsibility of a reinsurer.

And the same goes with the smaller insurance cases, which can be reinsured as well. MGAs can pay out small cases from their funds — and get a repayment from the reinsurer later. Or, if it is a big case, wait for the reinsurer to pay out, and then give the money to the client.

A DEEP DIVE INTO INSURANCE FINANCIALS

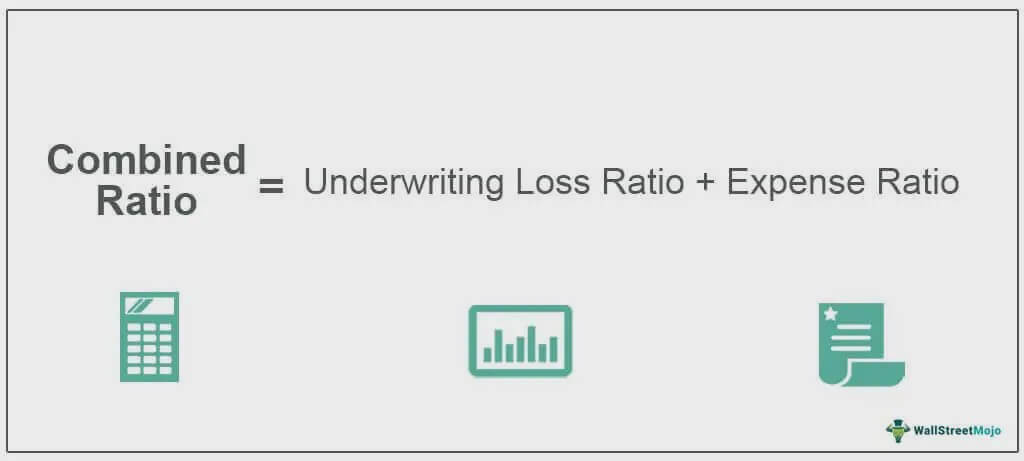

There are 2 groups of expenses that an insurance carrier operates with:

- The first group consists of operational expenses that include all sales, marketing, and administrative expenses. A benchmark for operational expenses in motor insurance takes 25–36% of written premium.

- The underwriting loss ratio makes up the second group of expenses. These are the expenses related to claims administration, coverage, etc. This part of expenses has about 70% of the written premium.

Usually, MGA has a lean structure, which means that the operations are more efficient and operational cost is lowered. So, the situation with operational expenses is clear and does not need our attention right now. But the underwriting loss ratio can be problematic, with almost twice as much in costs for the P&L of an insurance company.

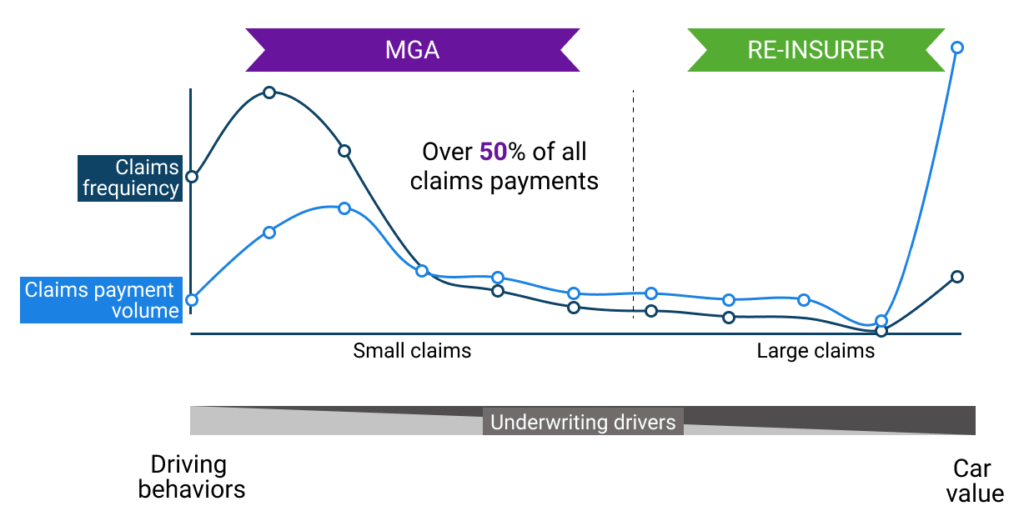

Regarding the loss distribution, almost 70% of all claims are small-size, which in value would make up about 50% of all payments on claims. To make it clear, we will look at how it works in the company of one of our Eastern European customers, specializing in the low-cost segment, and use it as an example.

Mobile telematics cannot influence thefts or total losses. That is why MGAs’ main focus is minor claims that could be affected by mobile telematics.

If we take the structure of loss distribution, we would see that over 50% of all losses are approximately less than $1500. So, these are minor losses. These are neither total losses of vehicles nor auto thefts — these are smaller damages, minor accidents, that are caused by the regular usage of the car. The purple part in the chart depends on how well one drives their car, not on the vehicle price as much. But there is no way the latter can be ignored.

The classic underwriting development is based on the car price. On the chart, the two factors (driving behaviors and car value) go together, just like mobile telematics go together with the classic scheme of underwriting. With mobile telematics, the number of accidents can be lowered by preventing high-risk drivers from appearing in the client base. But the accidents will occur anyway, and it is not going to be the same car model over and over again.

Imagine two equally good drivers — one on a Toyota Corolla and one on the Rolls Royce. Both of them, unfortunately, had scratched the lights on their vehicles. Even though the damage is seemingly the same, the price for repairing could not possibly be the same. The same thing goes in the underwriting: It is clear that the policy price for the Rolls Royce cannot be the same as the Toyota Carolla’s one — at least because the spare part cost will be different.

THE “TRY BEFORE YOU BUY” PRODUCT

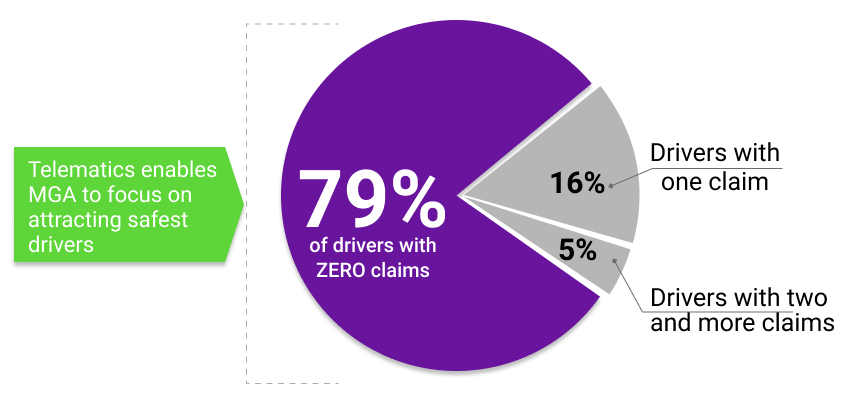

Based on our experience, we can make an assumption that no matter how many clients you have per year, there is an average of 60% accidents annually depending on the market. And mobile telematics can lower that number for your business to at least 50%. It could give you enough information to learn beforehand about the drivers’ behavior and whether the policy should be sold to them or not.

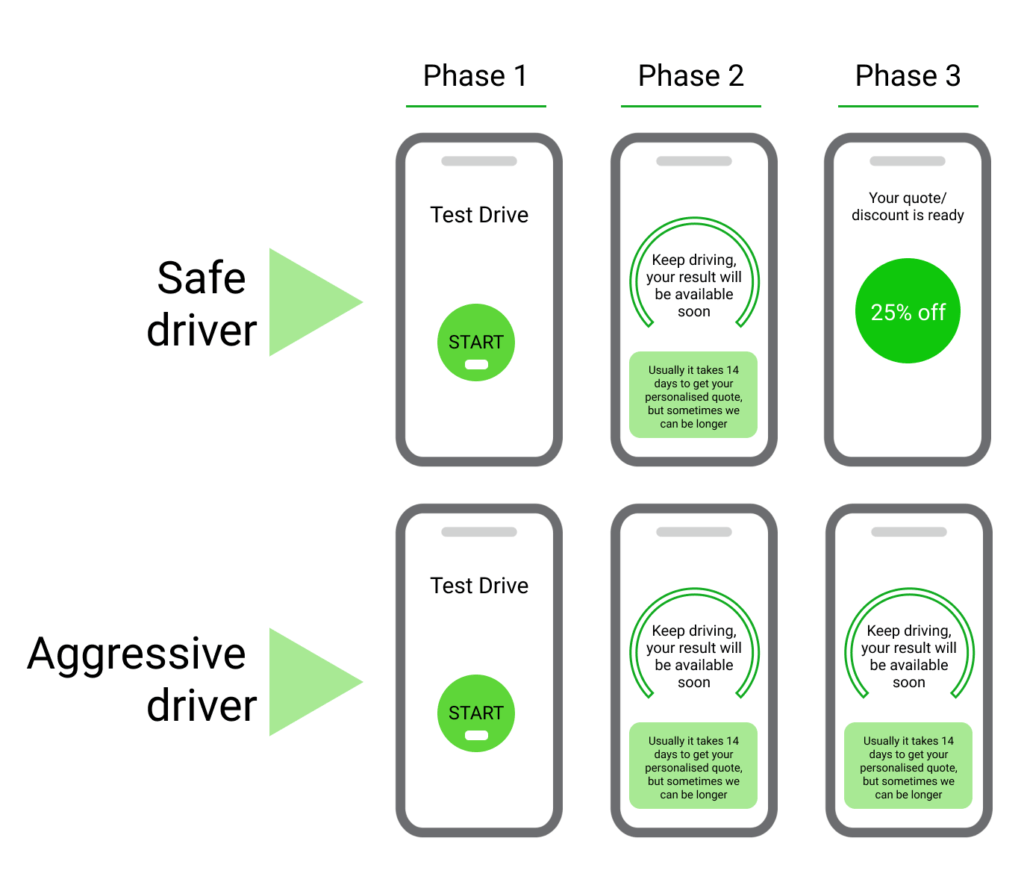

One of the well-known telematics products, that is widely used in the insurance business, is called “try-before-you-buy”. The TBYB model boosts the process of adapting to UBI by offering drivers a mobile application that gathers driving data. This way, insurers have a tool to understand risks before insuring a driver.

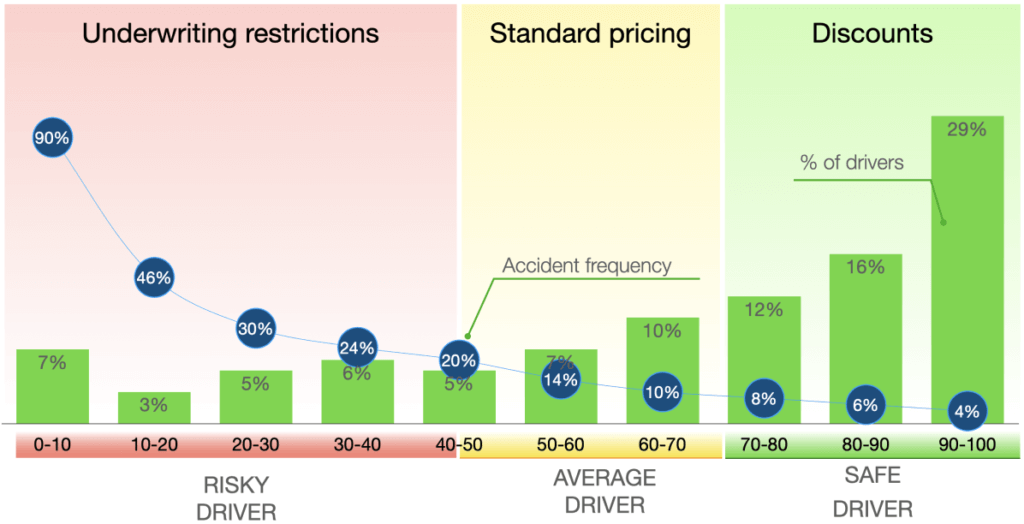

The chart below is an example of the portfolio of drivers who participated in the “try-before-you-buy” program to get a welcome discount.

As we can see, there are more safe drivers than the ones who are considered to be risky. This asymmetry can be easily explained by self-selection. Usually, risky drivers do not want to participate in the program and pass the opportunity to get a lowered policy price. However, even some of those, who had decided to test their driving behavior, were recognized and marked as risky. Selecting low-risk segments enables insurance carriers to improve their risk portfolio.

The “try-before-you-buy” is a great method to see how well it works, especially if that is your first telematics product. Clients download the app, drive for a while, and get a quote based on driving behaviors and car usage mode. That gives companies enough data to evaluate a risk level before signing an insurance contract

Product conditions are as follows: download the app, drive for 2 weeks and get the personal policy price. There is a dashboard in the app, showing the result and how many days there are left before the client can see the insurance price. Some companies use the trick to bar bad drivers — making the evaluation phase endless. Instead of providing a quote, they would constantly say: “please, drive more”.

As we know, insurance is a product bought to a certain date. So, bad drivers that were moved through the moment of renewal by asking to drive for more days, did not have a choice but to buy insurance from other companies. As a result, insurance carriers reassure themselves and their client base from risky drivers, basically cleaning up the underwriting base. Fair to say that the better bunch of drivers did receive the insurance price, and because it was reduced for them, they bought it immediately.

CAN MOBILE TELEMATICS AFFECT RISKY DRIVERS?

Driving factors of how the drivers use their vehicles help to predict how much losses they potentially can bring. With the help of mobile telematics, insurers selected a segment of good drivers (purple), that with high probability would not have accidents in general, and focused on them. Drivers, with a higher risk (grey), were barred with underwriting restrictions and were met with the compulsory deductibles.

However, an accident can occur with a good driver as well. In any situation, it is possible to work with both risky drivers and drivers with claims, because mobile telematics enables insurers to modify the driving behavior of their clients. Such alterations are achieved by constant interaction with drivers via rewarding schemes and special communications, that lead to a reduction of the risk level.

WHERE TO START

This way of approaching the insurance business is sustainable and what is more — easy and profitable. By reducing administrative costs and investing in mobile telematics, you can side with profitable businesses and drive insurance innovations. So, if you want to repeat the success of existing MGAs across the globe, you already have everything you need to start.

Damoov has plenty of tools available for you to kick start implementing safe driving mobile applications into your business. Simply use the SDK and API to power mobile telematics inside your 3rd party mobile application or use Zenroad — an open-source free tracking app to deploy your new safe driving app in a day.

Frequently Asked Questions (FAQs)

What do insurance companies use telematics for?

The use of telematics helps insurers more accurately estimate accident damages and reduce fraud by enabling them to analyze the driving data (such as hard braking, speed, and time) during an accident. This additional data can also be used by insurers to refine or differentiate UBI products.

How does telematics car insurance work?

Telematics works through a device installed in your car or phone app and uses GPS technology to monitor your driving. Telematics data is often recorded using a small ‘black box’ fitted into your car – sometimes called a telematics box.

Can telematics increase premium?

Yes. If the telematics device records that you’re regularly speeding or driving dangerously, your insurer has the right to increase your premium. You’ll also risk a higher premium if it shows that you’re driving late at night and in the early hours of the morning.

Useful links

- Company website: https://damoov.com

- Open-source telematics app: https://damoov.com/telematics-app

- Telematics SDK: https://damoov.com/telematics-sdk

- Telematics API: https://damoov.co/api-services

- Developer portal: https://docs.damoov.com

- Datahub: https://app.damoov.comm

- Github: https://github.com/Mobile-Telematics