Safe Driver Discount Insurance Products in the USA

Safe drivers are less likely to meet with accidents. Insurance companies make money when someone pays a premium but doesn’t claim. Therefore, insuring compliant drivers is a more profitable option for Insurance companies.

Just like banks prefer giving out loans to customers with good credit histories.

When it comes to loans, there is an objective measure of credit history: The Credit Score. So the task for the banks is easy: they can tie their interest rates to the borrower’s credit score (lower interest rates for higher credit scores).

Unfortunately for the insurance industry, it has been a trickier affair. Unlike Credit Score (which is accepted as credit history quality), there has traditionally been no objective measure for safe driving.

Safe Driving Score Using Telematics

Enter Telematics.

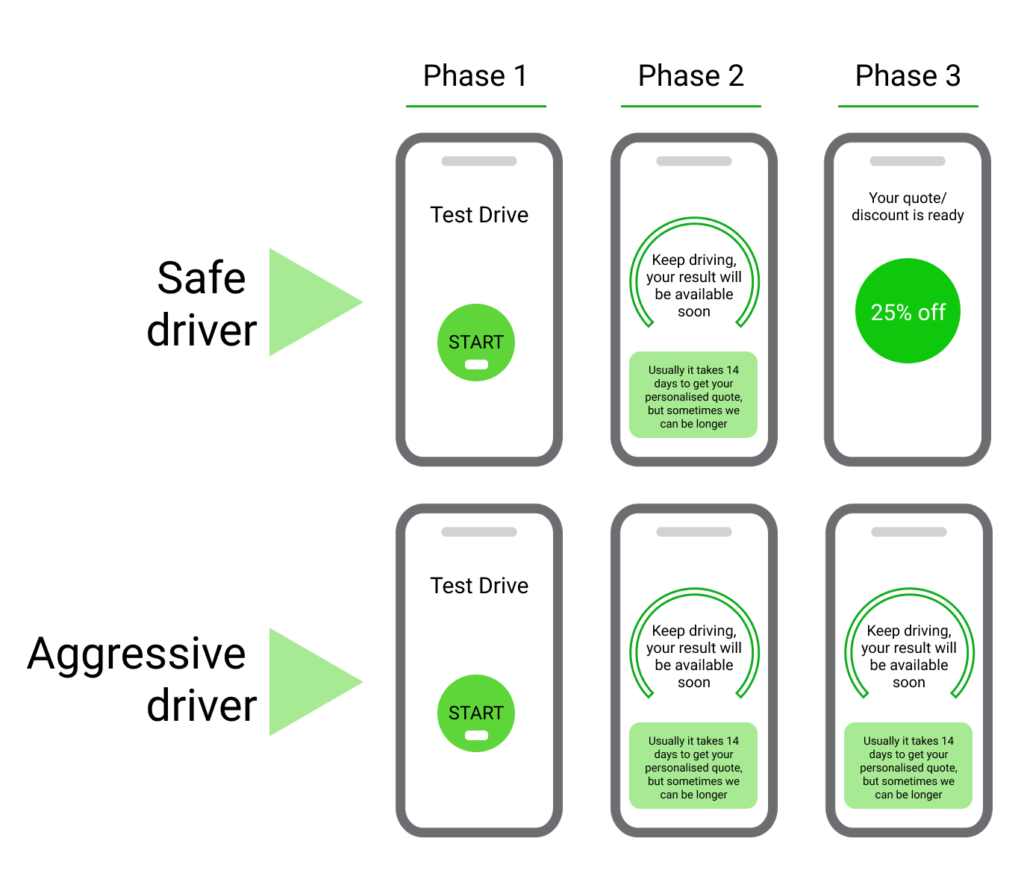

With Mobile Telematics, it has been possible to measure an individual’s driving safety. Telematics apps use advanced analytics to analyze a driver’s behavior and then tie it to the probability of the driver meeting with an accident.

Companies like Damoov, which are selling APIs and SDKs for mobile telematics, have successfully assigned Safe Driving Scores. This advancement makes it possible for insurance companies to tie premiums to the scientific basis of Safe Driving Score.

Unlike Credit Scores assigned by independent bureaus, in the world of insurance, the insurers themselves develop their measurement using the data and models provided by 3rd party API solutions like Damoov.

Usage of telematics in Insurance is definitely on the rise, and thus Mckinsey considers Telematics in their list of top 10 Insurtech trends.

Now, let’s take a look at the top Safe Driver Discount Insurance products in the US.

Top Safe Driver Discount Insurance products in the US

Liberty Mutual RightTrack®

The RightTrack® Program by Liberty Mutual Insurance helps customers save up to 40% on premiums based on their safe driving. By registering for Liberty Mutual RightTrack®, a customer is eligible for a 10% discount on premiums by default. They can get a further 5% to 30% discount based on their driving safety.

To participate in the program, drivers need to install the iOS or Android app for Liberty Mutual RightTrack®. The driver needs to be a part of the program to avail of the offer for the entire period. At any given time, the dashboard shows the days left for the program to end along with the projected annual savings in USD.

The four factors that are used for the scoring are:

- Braking

- Acceleration

- Night Time Driving

- Miles Driven

The driver also needs to drive at least 125 miles during the 90-day program to be eligible for the discount.

Safeco RightTrack®

The Safeco RightTrack® program allows drivers to save up to $513 per year. The discount can be availed lifelong.

Even the Safeco RightTrack® program offers a minimum discount for registering for the program. The program duration is 90 days & to participate in the program; the driver needs to install the Safeco RightTrack® app on Android or iOS.

Like all other RightTrack® programs, the parameters used for measuring driving safety are:

- Braking

- Acceleration

- Night Driving

- Miles Driven

State Farm Drive Safe & Save

Drive Safe & Save™ is the Safe Driving Discount program by StateFarm® Insurance. In the case of Drive Safe & Save – there are two ways of participating:

- Enrolling via Mobile

- Enrolling via Connected Car (Example: Ford, Lincoln)

StateFarm lists a set of eligible connected cars that can send information directly. The driver needs to download the Drive Safe & Save app for all other vehicles to send information to StateFarm.

In the case of Drive Safe & Save™, one can avail of up to a 30% discount. Unlike RightTrack ®, which is 90 days, Drive Safe & Save ™, collects information all year round & the discount kicks in at the time of renewal.

Know-Your-Drive by American Family Insurance

The Know-Your-Drive program by American Family Insurance helps buyers save up to 20% on car insurance.

Know-your-Drive provides the following benefits:

- Discount up to 20% based on safe driving

- Access to data to get detailed insights on one’s driving habits

- Free access to tools to improve driving

Know-your-Drive automatically provides a 10% discount on enrolling. The remaining 10% discount is based on the driving score.

As a bonus, American Family Insurance (AmFam) provides the Travel Peace of Mind Package, which includes the following:

- Emergency Roadside Service

- Rental Reimbursement

- Road trip accident accommodation

- Accidental death and dismemberment benefits

Besides the usual factors (such as braking, accelerating, etc.), Know-your-drive also considers distraction and distance traveled above the speed limit, for score calculation.

Frequently Asked Questions(FAQ)

What does a driving score mean?

Driver Score uses the sensor data from the connected vehicle to calculate a driver score for each trip. This sensor data includes odometer reading, acceleration, and speed. The driving performance for every trip is mapped to a score on a scale of 0-100.

What are insurance discounts?

Policy discounts are discounts that insurers offer in order to retain you as a customer. Driver discounts are offered to compliant drivers who pose a relatively low risk to their insurer based on characteristics like age, driving history, and annual mileage.

Useful links

- Company website: https://damoov.com

- Open-source telematics app: https://damoov.com/telematics-app

- Telematics SDK: https://damoov.com/telematics-sdk

- Telematics API: https://damoov.co/api-services

- Developer portal: https://docs.damoov.com

- Datahub: https://app.damoov.comm

- Github: https://github.com/Mobile-Telematics